Tired of feeling overwhelmed by your finances? A digital planner can be a powerful tool to streamline your budgeting process and achieve financial freedom. With its intuitive interface, you can effortlessly record spending, establish realistic targets, and visualize your financial standing. A digital planner also provides invaluable insights that can empower you to make smart financial actions.

By leveraging a digital planner, you can upgrade the way you manage your money and cultivate a healthier relationship with their finances.

Unlock to Digital Budgeting: Plan, Track, and Achieve

Take control of your finances with the comprehensive digital budgeting guide. This book offers a clear roadmap to mastering personal finance in today's digital world. With actionable steps and practical strategies, you can confidently plan your spending, analyze your income, and achieve your financial objectives.

The book covers a wide range of topics, including:

- Developing a realistic budget

- Leveraging budgeting apps and software

- Pinpointing areas for saving

- Investing wealth through smart financial choices

Whether you're a novice or seeking to optimize your existing budgeting skills, this book provides the guidance you need to achieve financial well-being.

Optimize Your Finances With These Digital Products

In today's fast-paced world, managing your finances can often feel overwhelming. Luckily, there are a plethora of digital products designed to boost your financial literacy and ease your daily money management tasks. Consider budgeting apps that automatically categorize your spending, allowing you to identify areas where you can cut costs. Employ investment platforms that offer personalized portfolios based on your risk tolerance and financial goals.

- Additionally, digital banking services provide secure control to your funds, enabling you to transfer money with ease.

- Remember that choosing the right digital products depends on your individual needs and preferences.

Budgeting Made Easy : A Step-by-Step Guide with Digital Tools

Take the stress out of budgeting with this easy-to-follow guide. These days, there are tons of fantastic tools to help you track your expenses, set realistic goals, and even schedule your savings.

First, calculate your earnings. Then, list your monthly expenses. Don't forget to consider expenses such as rent, services, food, and digital, products, planner, budget, book leisure activities.

Once you have a clear picture of your financial situation, you can commence dividing your resources wisely. Set aside money for your upcoming and long-term goals.

- Try online budgeting tools

- Categorize your spending

- Plan for the future

With a little planning and the right tools, budgeting can be simple.

Unlock Financial Freedom: Your Digital Planner for Success

Are you tired with the hustle of overseeing your finances? Do you desire a future where money is abundant? A digital planner can be your powerful tool to transform your financial path. This isn't just another app; it's a comprehensive system designed to direct you towards monetary freedom.

- Use budgeting strategies that function for your lifestyle.

- Track your outlays with precision.

- Showcase your growth in a clear manner.

- Establish realistic financial targets and achieve them with confidence.

Empower yourself with the knowledge and tools to {take{ control of your finances. Start your journey towards financial freedom today!

The Power of Planning: A Digital Approach to Budget Management

In today's digital age, managing finances effectively has become simplified. With plenty of budgeting apps and online tools, individuals can take control of their financial outflows like never before.

Leveraging a digital approach to budget management offers numerous perks. Firstly, it allows for real-time tracking of earnings and costs, providing invaluable insights into spending habits. Secondly, these apps often feature automation to classify transactions, making it easier to recognize areas where spending can be curtailed.

Moreover, many digital budgeting tools provide customized financial guidance based on individual goals and circumstances. This proactive approach empowers individuals to make intelligent financial decisions and realize their fiscal aspirations.

, In conclusion, the power of planning, when combined with a digital approach, can transform the way individuals manage their finances, leading to greater command over their wealth.

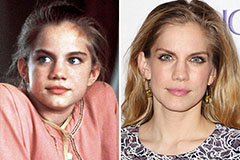

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!